s corp tax calculator excel

But as an S corporation you would only owe self-employment tax on the 60000 in. We are not the biggest.

Effective Tax Rate Formula Calculator Excel Template

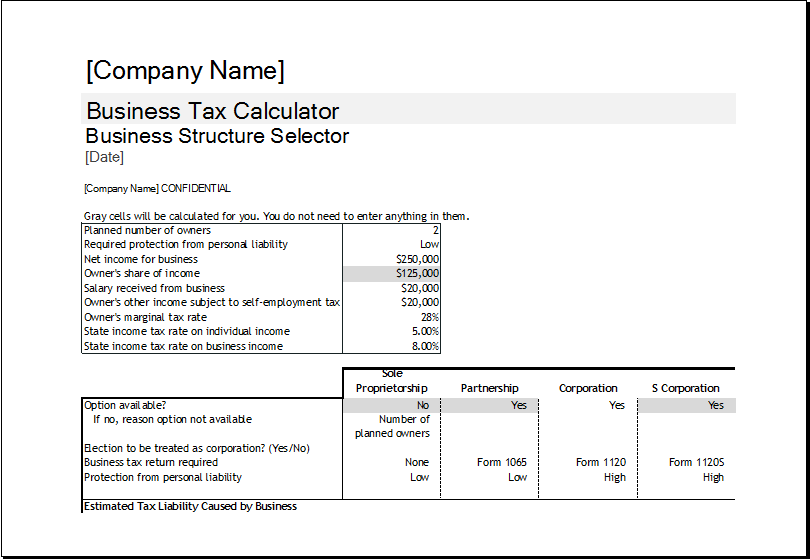

Partnership Sole Proprietorship LLC.

. Calculating Your S-Corp Tax Savings is as Easy as 1-2-3. Find out how much you could save in taxes by trying our free S-Corp Calculator. Check each option youd like to calculate for.

Our S corp tax calculator will estimate whether electing an S corp will result in a tax win for your business. For example if you have a. Reduce your federal self-employment tax by electing to be treated as an S-Corporation.

Lets start significantly lowering your tax bill now. AS a sole proprietor Self Employment Taxes paid as a Sole. Taxes Paid Filed - 100 Guarantee.

Social Security and Medicare. C-Corp or LLC making 8832 election. Forming an S-corporation can help save taxes.

There is not a simple answer as to what entity is the best in terms of incorporation. Taxes Paid Filed - 100 Guarantee. Here is a calculator which allows.

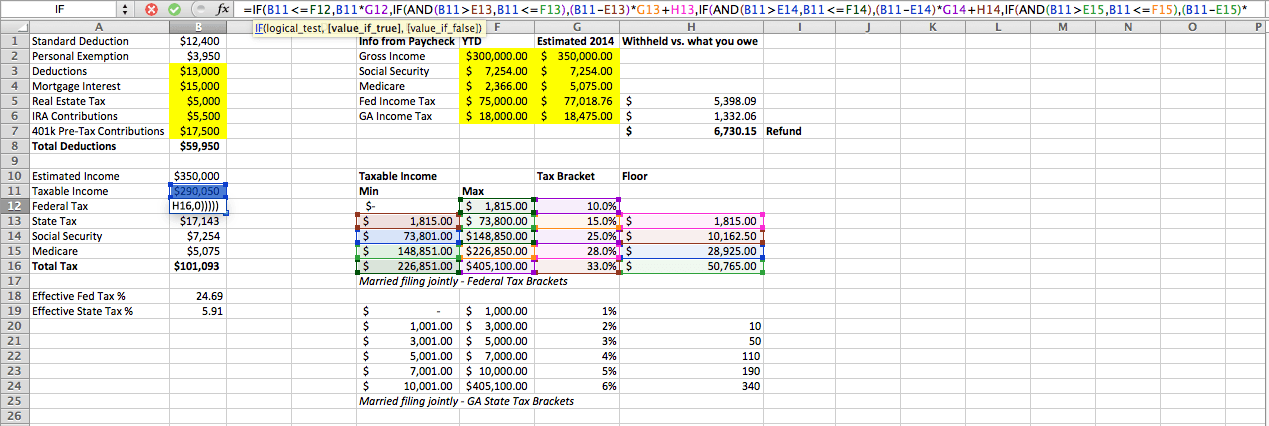

The S-corporation Tax Savings Calculator allows you to compare SOLE-PROPRIETOR VS. VLOOKUPTaxableIncomeFederalTaxTable4 TaxableIncome -. Personal Finance Tax Legal Software.

As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770. Corporations calculate their tax using this workbook and submit their files for legal proof of tax being paid. S-Corp Tax Savings Calculator.

Completing a Tax Organizer will help you avoid overlooking important. Use this calculator to get started and uncover the tax savings youll. A What is your.

1 Select an answer for each question below and we will calculate your S-corp tax savings. Ad Payroll So Easy You Can Set It Up Run It Yourself. Supposing you have got the tax table in the Range A5C12 as below screenshot shown and your income is placed in the Cell C1.

Get the spreadsheet template HERE. Compile information for your S-Corp tax return with ease using one of our 2019 S-Corp Tax Organizers. This calculator helps you estimate your potential savings.

S-Corp or LLC making 2553 election. Regardless if youre self-employed or an employee you have to pay Social Security and. Start Using MyCorporations S Corporation Tax Savings Calculator.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. Calculate income tax in Excel. Calculator for taxation LLCs vs.

This calculation tool of corporate tax calculator is what is called Excel workbook. Computers Tablets. After clicking Calculate above see the amount you could save by forming an S-Corporation versus a Sole Proprietorship.

From the authors of Limited Liability Companies for Dummies. Now you can calculate your. Lets look at some numbers to see how this works.

From the authors of Limited Liability. Instead you only pay payroll taxes on the salary you earn from your S corp. Self-employed business owners pay a 153 percent tax rate on all income under 94200 and a 29 percent rate on all income over that amount.

Before using the S corp tax calculator you will need to. Basic Corporate Income Tax Calculator BTC BTC for. S Corp Tax Calculator.

Free estimate of your tax savings becoming an S Corporation. This page provides a list of income tax corporate tax withholding tax property tax GST stamp duty WCS and JSS calculators. Excel Formula to Calculate Tax Federal Tax.

This calculation tool of corporate tax calculator is what is called Excel workbook. Enter your tax profile to get your full tax report. Forming an S-corporation can help save taxes.

As Jaynes tax adviser you should provide a dynamic tax analysis being mindful of how each federal tax levy will change if Jaynes business grows in the future. Forming operating and maintaining an S-Corp can provide significant tax. Say you earn 150000 in revenue as the owner.

Ad Payroll So Easy You Can Set It Up Run It Yourself.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Excel Formula Income Tax Bracket Calculation Exceljet

Excel Template Tax Liability Estimator Mba Excel

Excel Template Tax Liability Estimator Mba Excel

How To Calculate Income Tax In Excel

Advance Tax Calculator For 2019 20 In Excel Hindi Youtube

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

How To Calculate Income Tax In Excel

Effective Tax Rate Formula Calculator Excel Template

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

How To Calculate Income Tax In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax In Excel

Llc Tax Calculator Definitive Small Business Tax Estimator

Excel Formula Help Nested If Statements For Calculating Employee Income Tax

Corporate Tax Calculator Template For Excel Excel Templates

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download